Social responsibility: EOS puts financial education on the curriculum.

Three EOS employees grappled with the question of what responsibility companies have towards society nowadays. The result of their deliberations was the finlit foundation, a non-profit company that is getting involved before excessive debt occurs.

- One in ten Germans has excessive personal debt, and there is a similar picture in other EU countries like Finland and Poland. One of the main reasons is poor financial education.

- As a non-profit company, the finlit foundation is committed to more financial literacy. Its first initiative is targeting schoolchildren in the age group 9-12.

- EOS is utilizing its expertise in debt collection to prevent excessive personal debt.

“The only social responsibility of a business is to maximize its profits”: Nobel-Prize winning economist Milton Friedman would have to expect a lot of opposition to this statement nowadays. The world has become more complex, and companies do not just have a duty towards their shareholders. They publish corporate social responsibility reports, appoint CSR directors and rather than Milton Friedman they would be more likely to quote Michael Otto. The CEO of Otto Group, the parent company of EOS, has said: “If you have the opportunity to make the world a better place than you also have the responsibility to do so.”

“One in ten adults in Germany is in debt. Who else, if not EOS, has the expertise to do something about this?” says Jana Titov. Together with two co-workers she has established a non-profit company under the EOS umbrella that will not be involved in recovering outstanding receivables. Instead, the finlit foundation aims to prevent people getting into the debt trap in the first place.

Learning how to handle money properly – the earlier the better.

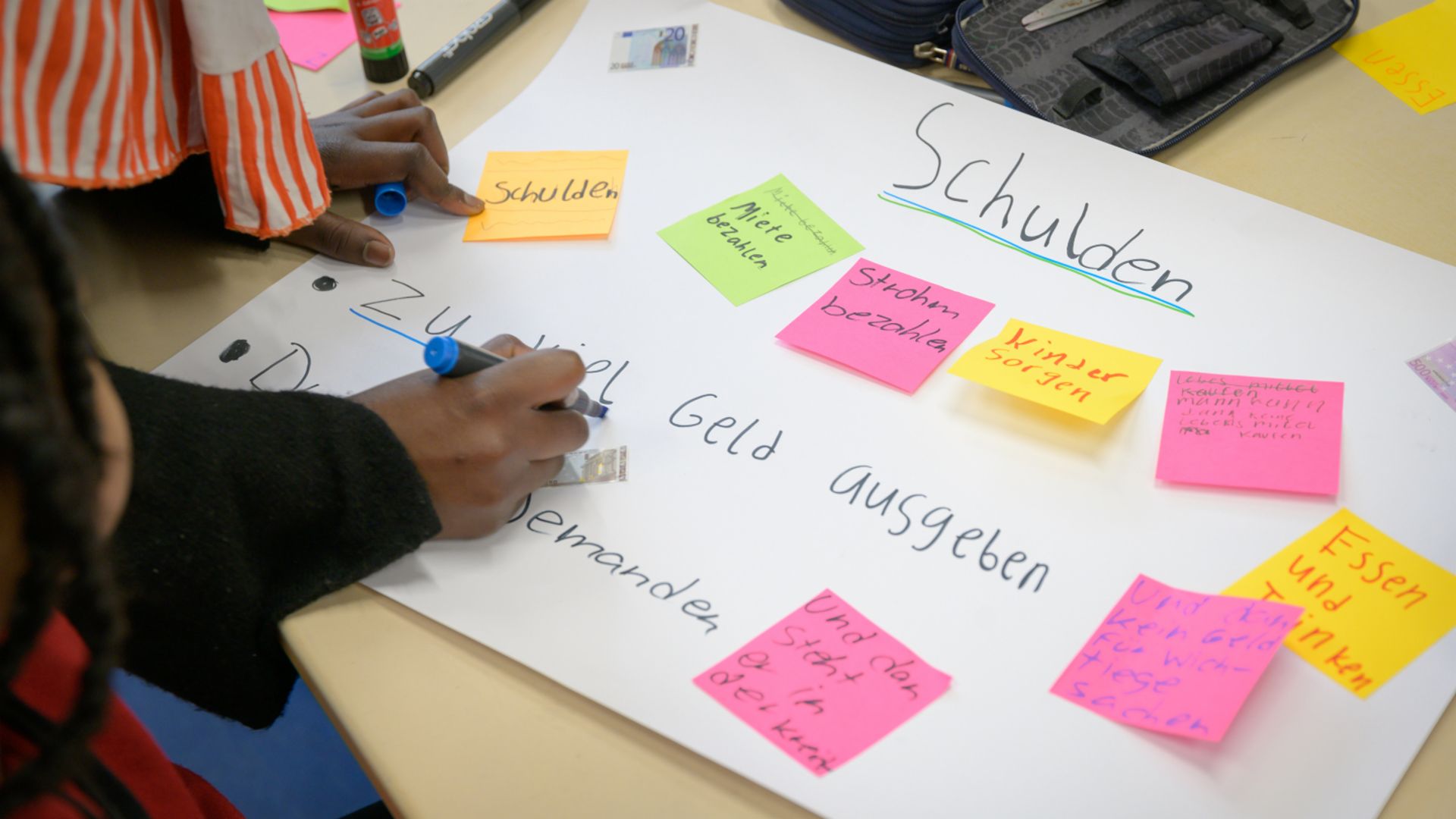

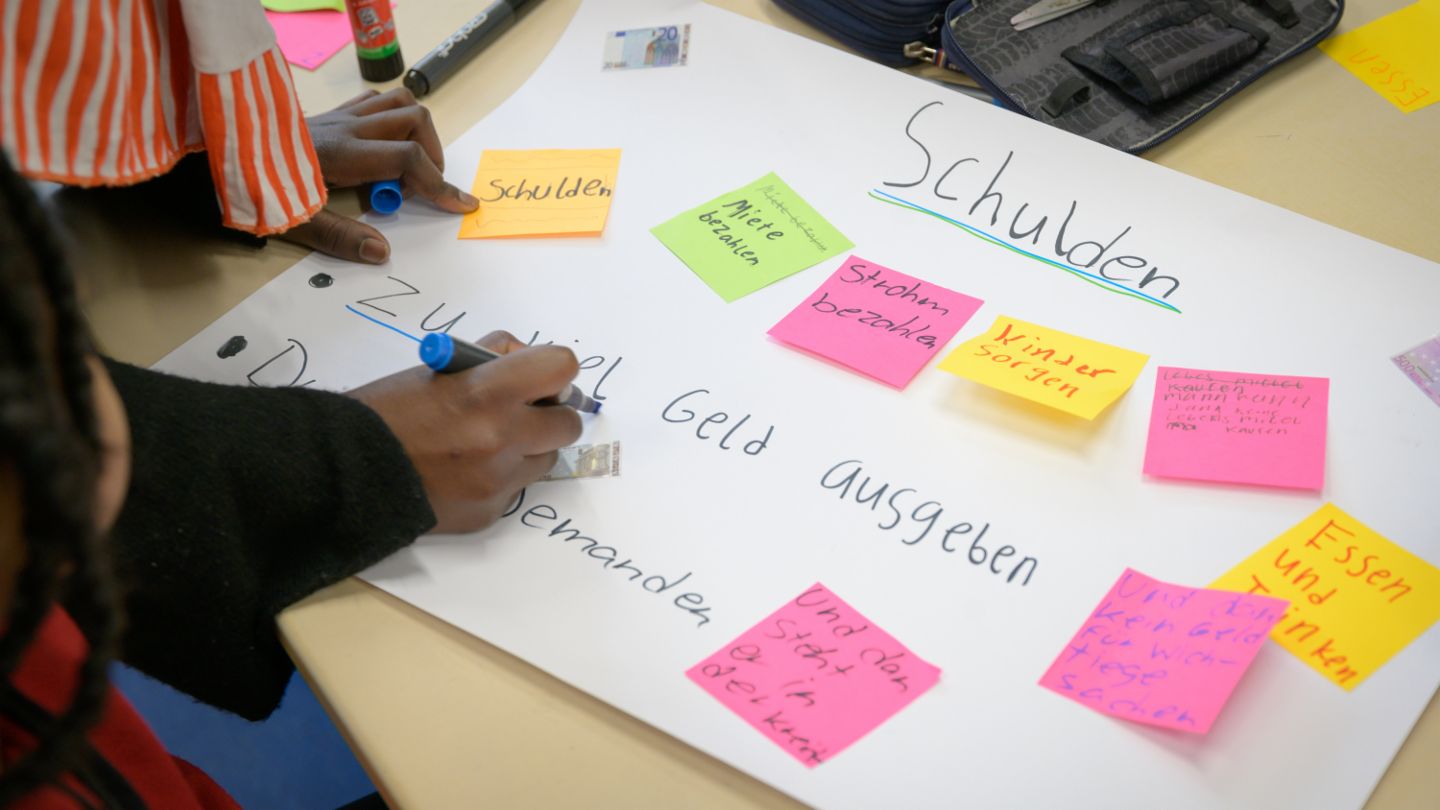

The first initiative is designed to give children the financial knowledge that they do not get in school. Because although geometry, curve sketching and integral calculus are important learning modules, they do not teach young people very much about the right way to handle money. The result is that many young people are also ending up in the debt trap. Many of them cite poor budgeting skills as the reason.

“The figures really make depressing reading. In a Europe-wide survey, just under half of those polled said that they had pretty much no financial education at all at school!” says Jana. However, in view of dwindling pensions and increasing life expectancy, it is the youngest members of society in particular who need to give more thought to their long-term financial security.

If you have the opportunity to make the world a better place then you also have the responsibility to do so.

“Because we come from the debt environment we naturally know what happens when people can no longer pay their bills,” says Jana. “It was very quickly clear to us that if we are really serious about our Purpose of a debt-free world then we have to reach out to people at a much younger age.”

Jana developed the idea for finlit along with her co-workers Jannik Steinhaus and Sebastian Richter as part of an international ideas competition at EOS. Although the trio did not win the contest, they continued to have faith in their idea. CEO Klaus Engberding was so taken by this commitment that the three colleagues were allowed to devote a fifth of their working time to developing a business plan. This was followed by a pitch to Dr. Michael Otto, chairman of the Otto Group Supervisory Board. Thanks to his own active involvement in foundations, he was also quickly convinced. From then on the team was able to invest half of its working hours to the finlit foundation.

From idea to educational program.

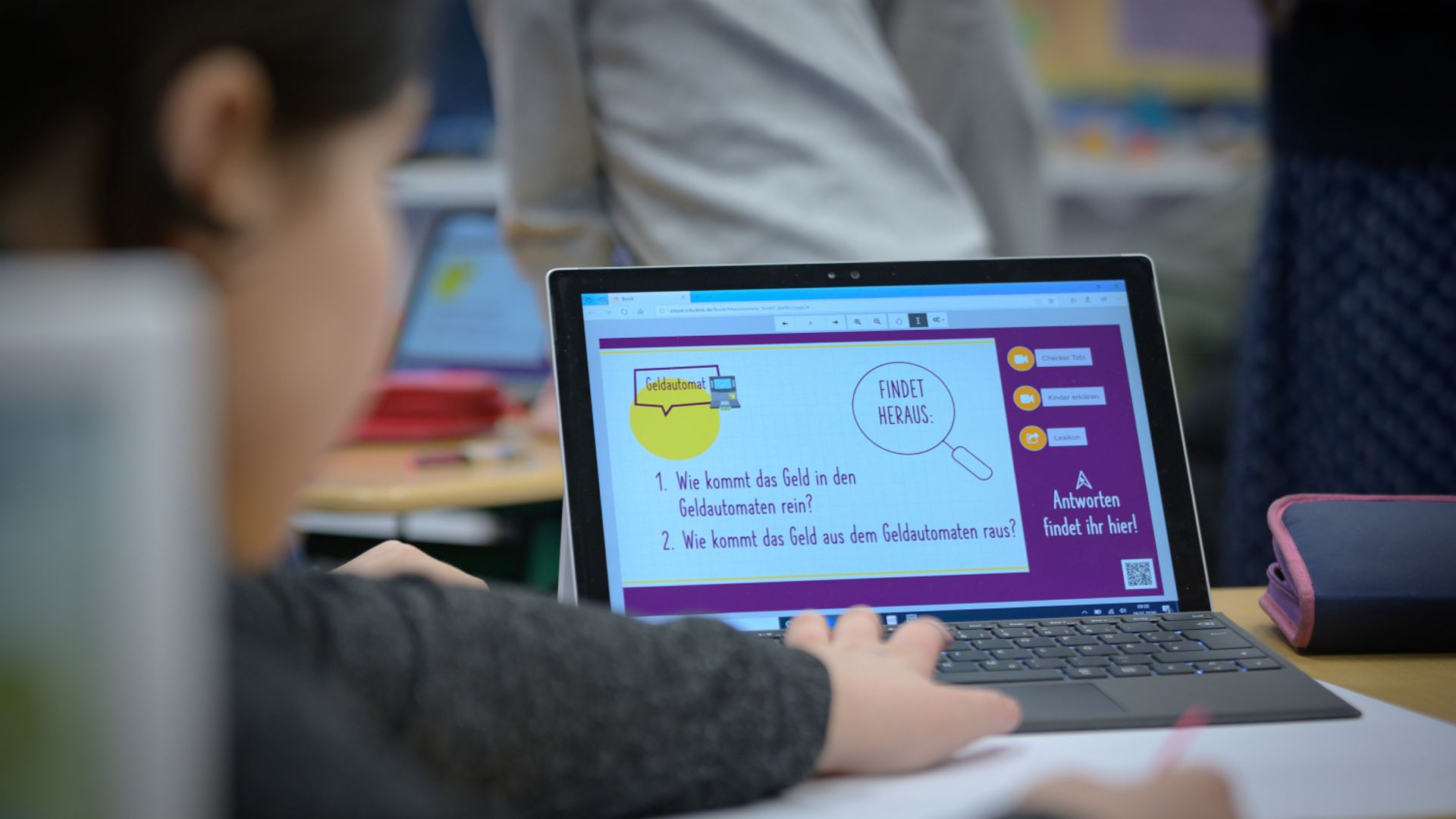

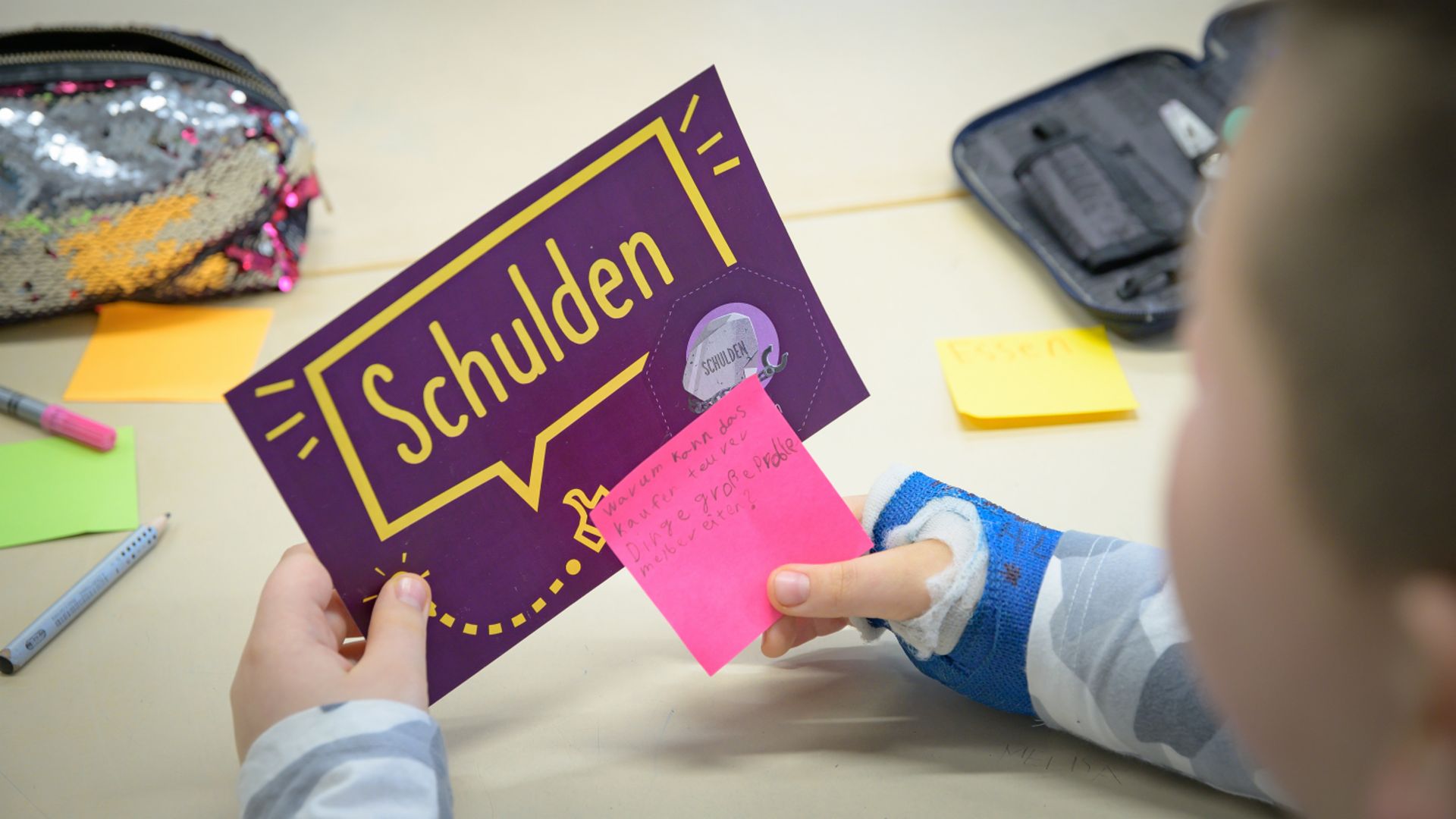

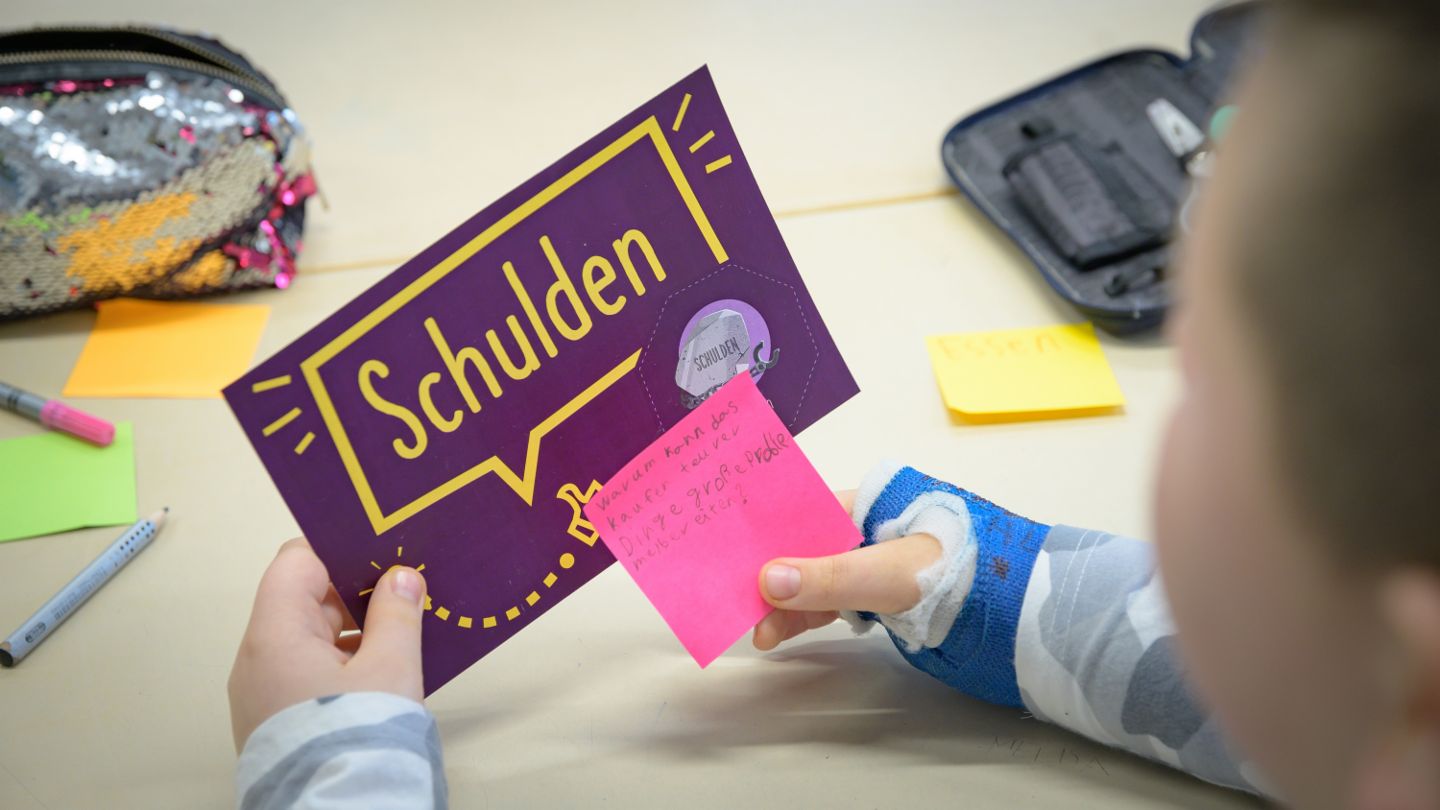

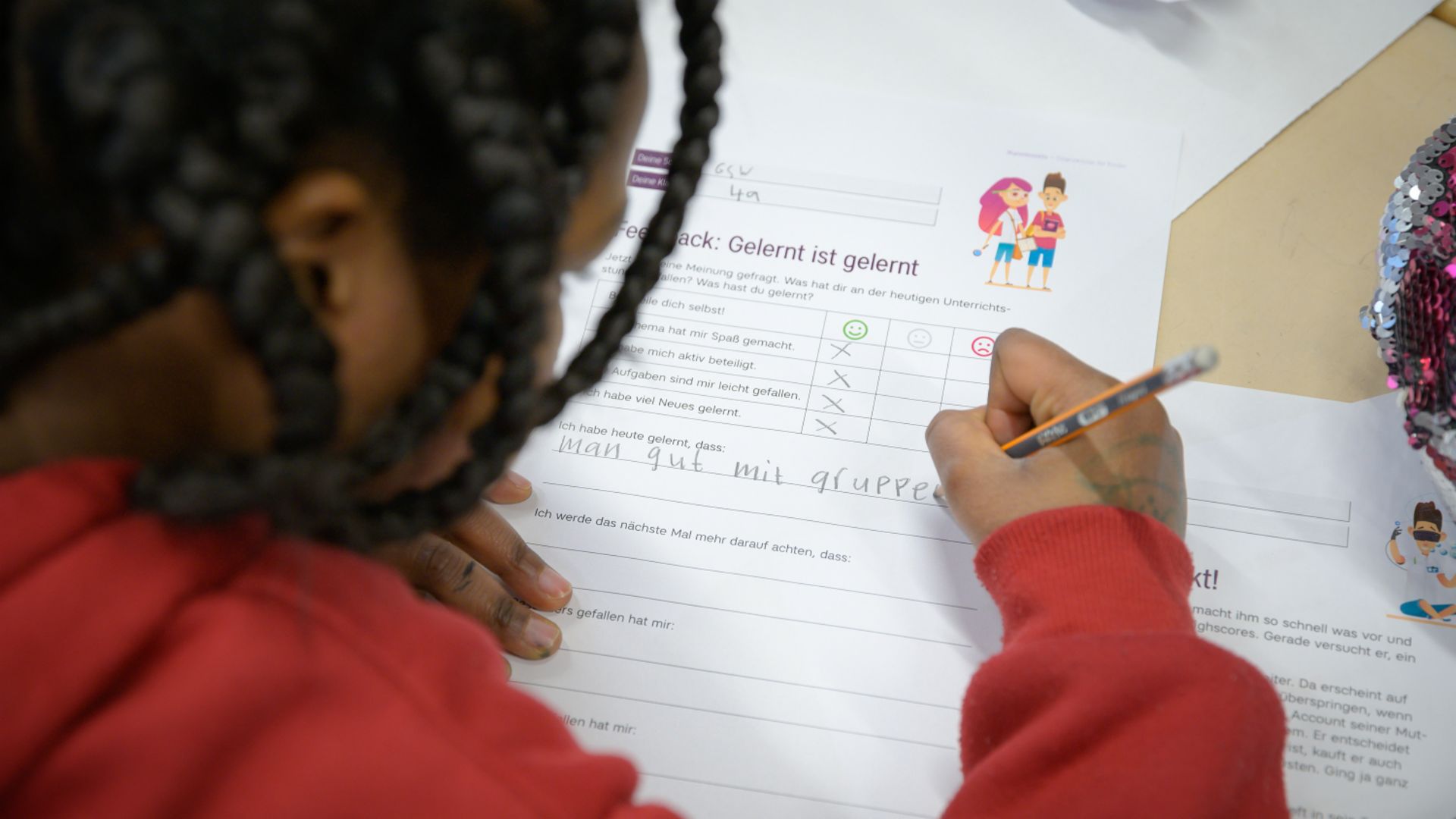

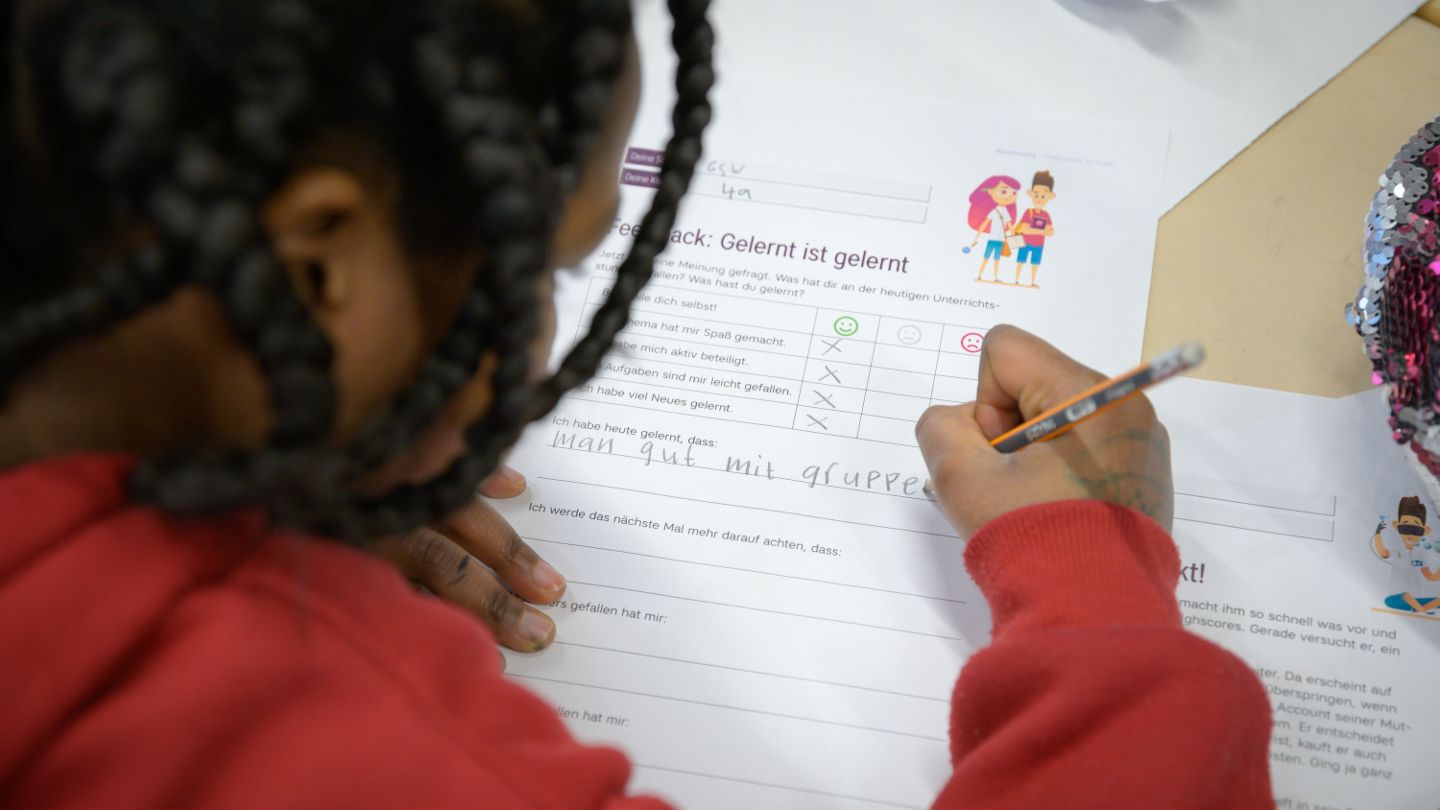

As a first step the team worked with experienced educational specialists to develop a program for children aged between 9 and 12. In some initial trial runs, the team determined the level of knowledge of the children and tested various teaching methods. This resulted in teaching materials like flash cards, a financial diary and an online learning portal. The feedback from teachers and pupils will be incorporated into the ongoing development of the program.

The project is currently in the pilot phase, when materials are being thoroughly tested again in the pilot schools. The rollout is then set to start in September this year, initially in Germany, although the intention is for it to also be extended internationally. In the meantime, Jana Titov and her two colleagues are able to devote all their attention to this project, because they are now working 100 percent for their non-profit, the finlit foundation.

EduFin boosts the self-confidence of orphans in Romania.

In Romania too, EOS staff are passing on their knowhow from the debt environment for a good cause. The volunteer group established by colleagues from EOS in Romania has about 20 members. They worked together to create the EduFin program to provide support with day-to-day matters to children living in an orphanage. Such tasks might include the right way to manage money or preparing for a job interview. Marina Tuca, call center agent and co-initiator of the program, is enthusiastic about the project. “What we get back from the young people is amazing. They show us their gratitude by giving us hugs or painting pictures for us. This truly warms my heart.” So she is happy to drive the 150 km on her free Saturdays to visit the children in their orphanage. And naturally, the Romanian volunteers are sharing knowledge and information with the trio from the finlit foundation.

Contact us

Photo credits: Otto GmbH & Co KG, Matthias Oertel, Peter Seifert / Helliwood media & education im fjs e.V. im Auftrag der finlit foundation gGmbH

Explore more from EOS