This is how you collect debt abroad

What can I do if my international clients do not pay? Just a few years ago, the answer was that you would be in for a lot of effort and not much chance of success. But these days, companies can use EOS to enforce claims in more than 180 countries – thanks to a global network of partners.

Collecting debts in Morocco sometimes takes time, says Stefan Cohrs. A lot of time. An employee of one of his local partners lived with a B2B debtor for three days, met the family members, ate and drank with them – and only then did the talk turn to business. “Those are the customs of the country”, says Cohrs, “and if you want to succeed, you have to be familiar with them.”

Cultural differences are part of Cohrs’ daily life. Working from Hamburg, the 46-year-old manages the EOS Cross-border Center – the point of contact for cross-border debt collection since 2010. “Of course, international receivables management did exist prior to this”, he says. But just a few years ago, it was complicated and time-consuming: “First, you had to locate the whereabouts of the debtor. Then you had to find a local partner who could take on the case. Then you had to send him the entire file by post and... And so on and so forth...” He shakes his head: “In many cases, it was simply not worth the effort.”

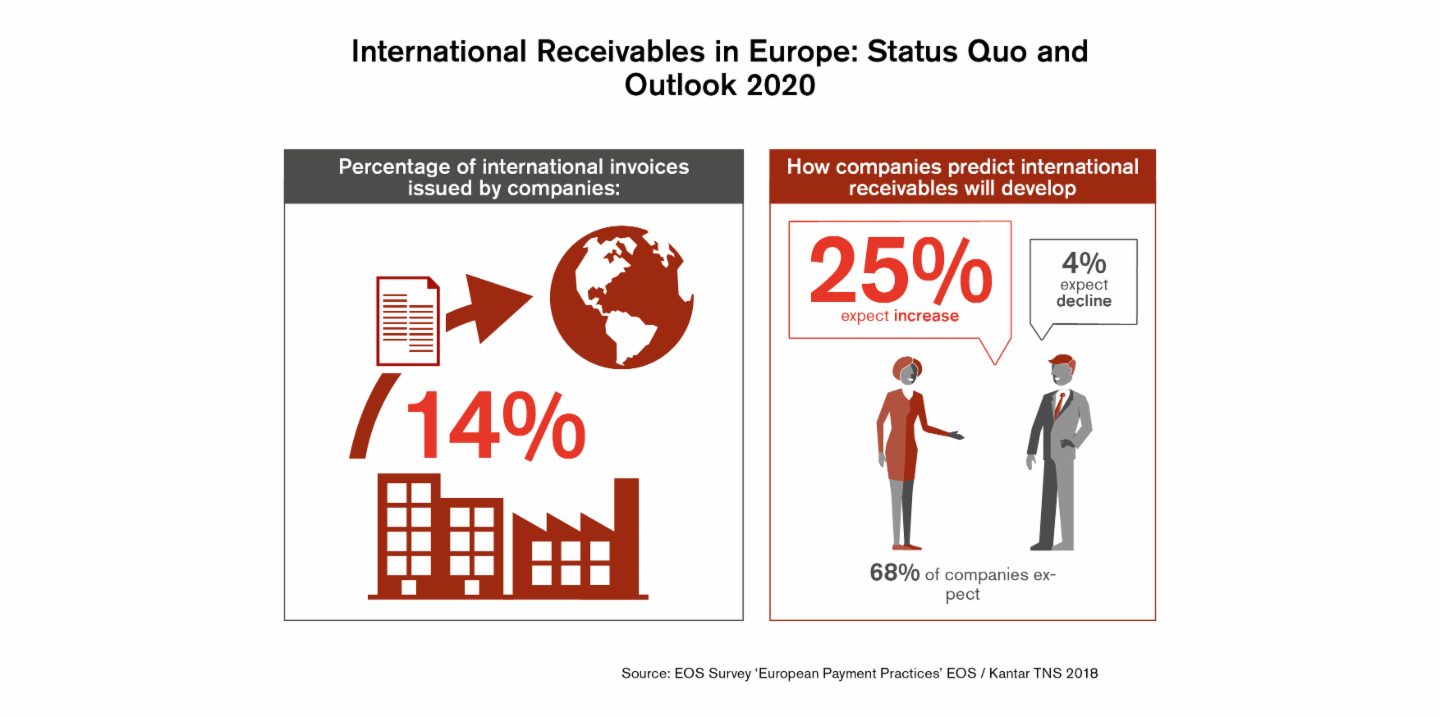

The demand for debt collection abroad is growing

But in the meantime, things have changed quite a bit. For one thing, the demand has increased. Initially, this was most evident in the B2B sector – for example with international forwarding companies and trading companies, for whom liquidity depends on the fact that outstanding debts can also be collected abroad.

But the number of B2C cases has also grown rapidly, “among other things, due to the growing migration between countries,” says Cohrs. Typical examples are for instance when employees return home after completing a job and leave behind mobile phone contracts or unpaid electricity bills. Where do you send them a reminder? What are the next steps I can take in my home country if no payment is received?

“At the same time, the technological options for enforcing legitimate claims internationally have improved,” says Cohrs. The core element at EOS is the “Global Collection Platform”. This is where local partners of the creditors can upload all the relevant information that the collectors need – from the amount of the debt and its interest to addresses and the complete file containing all the invoices and reminders. Many EOS partners use interfaces to connect the platform directly to their own collection system, which means they can follow the development of the case in real time. Using further interfaces in the direction of the client, this information can then be transferred to the client’s debtor management.

“We have created a unique selling point for EOS,” says Cohrs: “Many external partners who work with other networks confirm that our platform is the most professional of all debt collection companies.” This is very likely also thanks to one of the many helpful tools – “Global Wiki”, which lists legal specifics, characteristics and “good to knows” of many countries.

The differences between the ways that people do business and talk about money in different countries never cease to amaze me

European countries also have specific legal features

There are quite a few of these – and some are rather bizarre, as Cohrs has learned: “In Belgium, for example, debt collectors may call the debtor at the earliest ten days after sending the first letter. In France, they have to accept checks that may later bounce, and in some Eastern European countries they have to know the name of the debtor's mother if they want to find his address in the central register and send him a written warning.

Cohrs has eight staff members who gather this information, send out newsletters and make sure of on-going technological development of the platform. But the Cross-border Center is more than a platform operator, says Cohrs: “We are an enabler. To summarize it in one sentence, our task is this: We ensure smooth interaction.”

The global partner network is regularly updated

This includes Cohrs and his associates also advising external and EOS partners, for instance through webinars, workshops, field training and meetings at events such as the annual Federation of European National Collection Associations (FENCA) conference.

“One of our most important tasks, however, is selecting our local partners,” says Cohrs. There are now 80 of these. Some of them serve several countries at the same time, ensuring that claims can now be enforced via the Cross-border Center in more than 180 countries.

70,000 cases in one year

Just last year, EOS partners processed 70,000 cross-border cases worldwide. In order to ensure smooth collaboration, Cohrs is also constantly on the move, flying from partner meetings in Lithuania and Italy to workshops in Lisbon, Oslo, Nantes and Moscow or a conference in Finland. “Traveling that much is quite exhausting,” he says. “But it is fun to deal with different cultures,.” “The differences between the ways that people do business and talk about money in different countries never cease to amaze me” In Scandinavia, people even laugh a lot at business meetings, says Cohrs. And in Portugal you first have a relaxed chat about soccer or food before you move on to business.